Feb 18, 2022

The importance of investing in people and scaling: a start-up walkthrough

The state of start-ups in the Canadian market is looking promising although there have been a few key components that are not seen commonly and one of them would be an approach of relying on a single individual to serve every purpose.

Paul Graham, the co-founder of Y Combinator and one of the most successful entrepreneurs around, sites three essential things to create a good startup.

- Good and ambitious people

- A product that solves a user problem

- Wise allocation of resources

Team Work

Solo founders take longer to outgrow the startup phase, simply, because achieving expertise across every domain is no small feat. A team made of a tech & biz (hacker and a hustler) has a higher chance of user growth than a team that is lacking either or both of them.

This is one of the reasons behind the exponential growth of Jani Ventures. The Jani combination for a team remains the golden triangle: hipster, hacker, hustler (aka designer, engineer, marketeer). As the founders serve their particular area of expertise and operate as one unit, the brand has been able to venture into various domains successfully.

Simply put,

Don’t be a one-person team.

Startups premature scaling

Premature scaling is a common phenomenon that hampers the growth of start-ups with potential. This is frequently observed in the industry when the management or core team gets carried away with a good start and ends up scaling without having either the infrastructure or the strategy for expansion. Every start-up must understand that successfully getting the ball rolling doesn’t prepare them for the plethora of challenges that they might have to face as a part of the expansion and penetration into different markets and segments.

Premature scaling is putting the cart before the proverbial horse. The more a company grows, the further away from profitability it becomes.

Michael A. Jackson

The mindset of the founders of a start-up is usually that they want to grow past the start-up phase and establish a stable brand in the market.

This implies,

- Achieving Jani product/market mix

- Understanding new customer acquisition and the cost thereof all the while keeping the COA lower than the ARPU (Average revenue per unit), brings the customers in. Hence, it is not time to scale if the COA is higher than your ARPU or the start-up has not been able to identify the lifetime value of your customers (price * repeated purchase) and your cost to acquire that user. The need to customize your business model is prevalent for every sale, meaning you’re not yet similarly acquiring customers. This means that the team is working in the business, rather than on the business.

Startup growth strategies

The order of stages that would result in a responsible and stable growth of any start-up would be as follows:

-

Customer/Problem hypothesis

Customer/Problem Hypothesis. In other words, customer identification & segmentation. One can’t monetize till this is not done. One must find a problem that is big enough, for a viable number of people and most importantly if they will pay you to solve their problem in whatever way. A startup needs to figure out the customer segment wherein your fix is a solution for their top 3 problems. -

Market/Product fit

Market/Product fit. Essentially an MVP which has three characteristic points:- The defined customer segment should be willing to use it or buy it initially.

- It should be scalable and should fix a clear and present problem to benefit to retain early adopters.

- It has a module to gather feedback from users for evolution. A startup need only ask itself a simple question, Does my product service have a large enough market for my startup to grow? This involves testing, validation, and finding the right people to talk to, to determine the core features.

-

Channel fit.

Channel fit. This one is quite simple and easily achievable in the terms of methodology;- Reduce COA in comparison to ARPU

- Control customer churn

- Optimize all sales funnels

Hence, it is not time to scale if the COA is higher than your ARPU or the start-up has not been able to identify the lifetime value of your customers (price * repeated purchase) and your cost to acquire that user. The need to customize your business model is prevalent for every sale, meaning you’re not yet similarly acquiring customers. This means that the team is working in the business, rather than on the business.

That being said, these are the very stumbling blocks and traps that we, at Jani Ventures Inc, are equipped and positioned to help startups avoid. With our lineup of vertical experts, every stage of the pitfalls is covered by us.

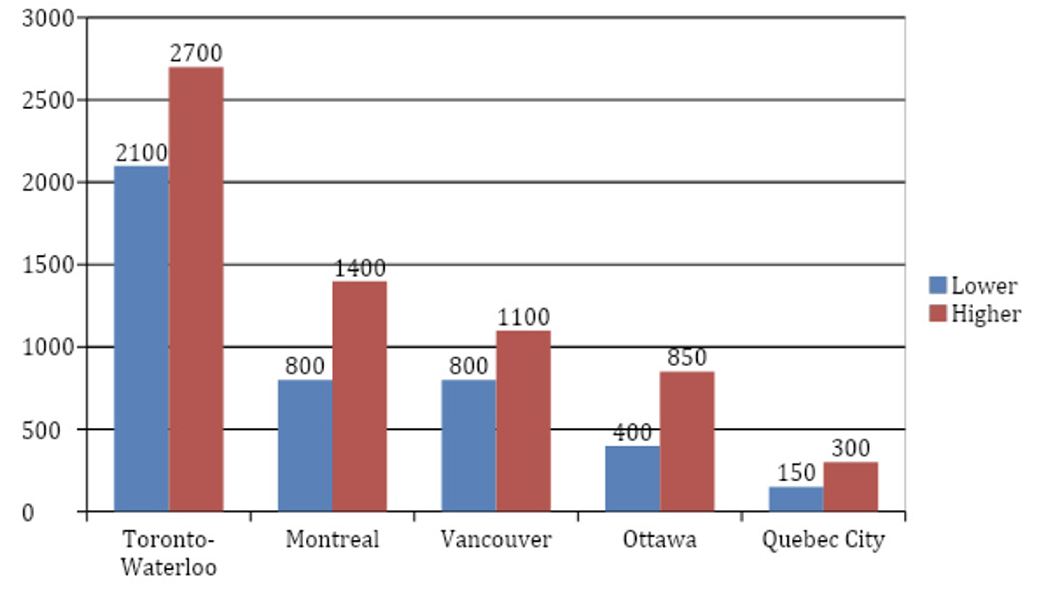

As a reference point the number of individuals and number in the start-up arena for the year 2019 looks like:

Author Aman Dutta is Managing Director of Jani Venture, a JC Team Capital concern/ company. The writer has kickstarted business across two continents and worked closely with the subject experts. His extensive experience produces enriched & insightful ideas backed by meticulous details & facts. His forte is funding, financing, venture capital, and investment.

FAQ

Startup: A business in the nascent stages of determining product-market fit, experimenting with customer segmentation, and working toward a positive contribution margin. Scaleup: A business that has already validated its product within the marketplace and has proven that the unit economics are sustainable.

Premature scaling is one of the most common reasons that cause the failure of a startup. According to certain reports, premature scaling occurs in more than 65 percent of companies and is responsible for the failure of almost 74 percent of tech-based startups.

- Validation of the product -market fit.

- Achievement of solid customer growth.

- Predictable and rising revenue.

- Having the appropriate in-house and outsourcing teams.